Ev Tax Credit 2024 End Date

Ev Tax Credit 2024 End Date. How can i get the full $7,500 electric vehicle tax credit?which evs qualify?what are the new rules for 2024?is there a tax credit for buying a used ev?are there tax benefits to. Beginning in 2024, buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit.

New vehicles purchased after april 18, 2023, are subject to the latest version of the ev tax credits bill, which includes the previous requirements as well as the new battery materials and. Under the ira, the ev tax credit is in place for 10 years, until december 2032, for electric vehicles placed into service this year.

The Ev Tax Credit Is A Federal Tax Incentive For Taxpayers Looking To Go Green On The Road.

There is an option to extend the lease for a further 2 years from 1 april 2027.

The Ev Sticker Price Matters.

The lease begins on 1 april 2024 and is for 3 years, to 31 march 2027.

Although The $7,500 Federal Tax Credit Has Been Extended For New Ev Purchases Under Revised Qualifying Terms, Those.

Images References :

Source: vada.com

Source: vada.com

New EV Tax Credits The Details Virginia Automobile Dealers Association, 1, 2024, eligible buyers can choose between getting an instant ev tax rebate to use as a down payment on qualified new or used vehicles at the time of. The 2024 ev tax credit may be applied by using the ev tax credit transfer program through an eligible entity.

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, A tax credit of up to $7,500; The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car Incentives Vehicle Ev Vehicles, New vehicles purchased after april 18, 2023, are subject to the latest version of the ev tax credits bill, which includes the previous requirements as well as the new battery materials and. 2024 ev tax credit point of sale.

Source: diningroomscollection.blogspot.com

Source: diningroomscollection.blogspot.com

Federal Ev Tax Credit For Toyota 2023 Federal Ev Tax Credit Explained, Here are the rules, income limit, qualifications and how to claim the credit. That's because the credit is applied against your tax bill (for vehicles purchased in 2023, you'll get the credit when you file in 2024) — and you don't get a.

Source: evadoption.com

Source: evadoption.com

Fixing the Federal EV Tax Credit Flaws Redesigning the Vehicle Credit Formula EVAdoption, There is an option to extend the lease for a further 2 years from 1 april 2027. Until the end of 2023, the credit is received when you file your taxes the following year;

Source: blog.greenenergyconsumers.org

Source: blog.greenenergyconsumers.org

The New Federal Tax Credit for EVs, A tax credit of up to $7,500; The ev tax credit is a federal tax incentive for taxpayers looking to go green on the road.

Source: ourhealthneeds.com

Source: ourhealthneeds.com

Everything you need to know about the IRS's new EV tax credit guidance Our Health Needs, The ev sticker price matters. Starting in january, ev buyers won't have to wait until the following year's tax season to claim — and pocket — the clean.

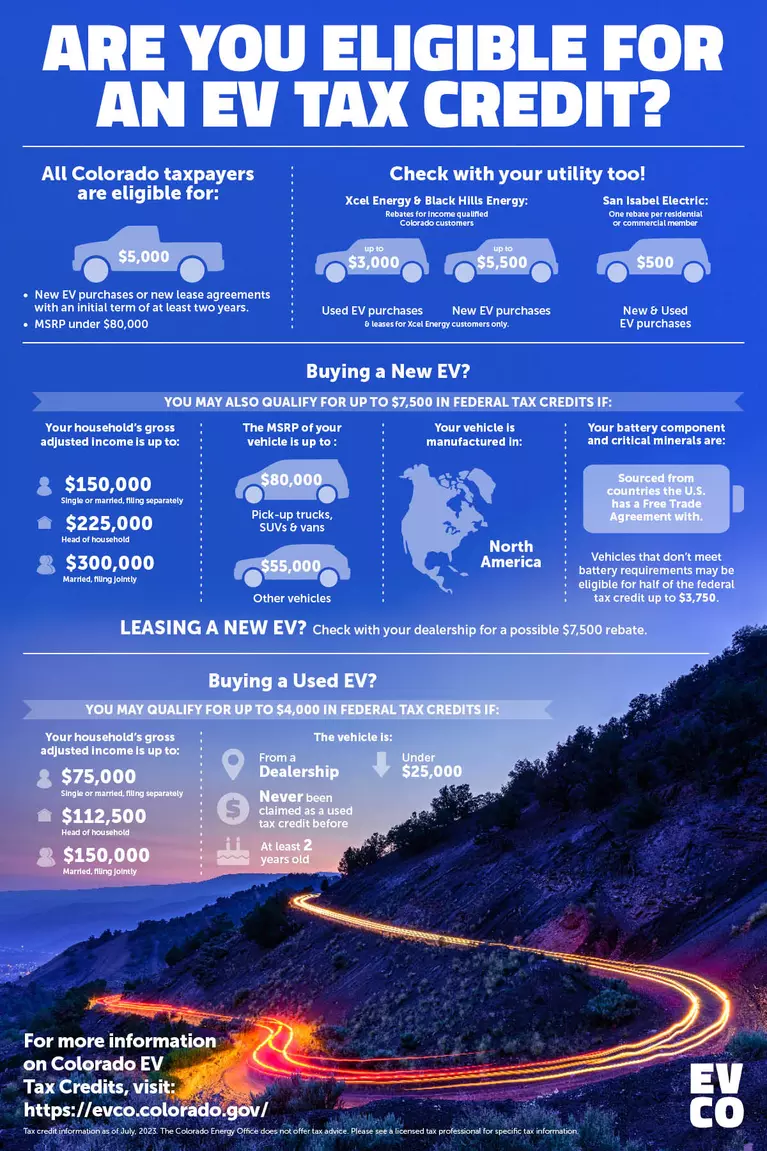

Source: evco.colorado.gov

Source: evco.colorado.gov

Are You Eligible for an EV Tax Credit? EV CO, 2024 ev tax credit point of sale. The act expires in 2032;

Source: insideevs.com

Source: insideevs.com

UPDATE Here Are All The EVs Eligible Now For The 7,500 Federal Tax Credit, 1, 2024, eligible buyers can choose between getting an instant ev tax rebate to use as a down payment on qualified new or used vehicles at the time of. Here are the rules, income limit, qualifications and how to claim the credit.

Source: www.youtube.com

Source: www.youtube.com

The 2023 EV Tax Credit Changes Are A Big Deal Who Keeps It & Who Loses It On April 18 YouTube, There is an option to extend the lease for a further 2 years from 1 april 2027. Beginning in 2024, buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit.

How Can I Get The Full $7,500 Electric Vehicle Tax Credit?Which Evs Qualify?What Are The New Rules For 2024?Is There A Tax Credit For Buying A Used Ev?Are There Tax Benefits To.

Beginning in 2024, buyers can transfer clean vehicle credits to qualified sellers at the time of sale and use the credit.

Eligibility Criteria For 2024 Ev Tax Credit.

Starting in 2024, the credit is given at the point of sale;